Florida Homestead Residency Requirements . (1) (a) a person who, on january 1, has the legal title or beneficial title in equity to real property in this state and who in good faith. every person who owns real property in florida on january 1, makes the property his or her permanent residenceor the. a taxpayer must reside on the property on january 1 of the relevant tax year in order to satisfy the requirements of article vii,. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her. if you elect to purchase a residence in florida, you also have the option to establish florida residency and claim the florida homestead. the homestead exemption in florida can save you hundreds of dollars in property taxes if you are a permanent.

from www.signnow.com

a taxpayer must reside on the property on january 1 of the relevant tax year in order to satisfy the requirements of article vii,. if you elect to purchase a residence in florida, you also have the option to establish florida residency and claim the florida homestead. the homestead exemption in florida can save you hundreds of dollars in property taxes if you are a permanent. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her. (1) (a) a person who, on january 1, has the legal title or beneficial title in equity to real property in this state and who in good faith. every person who owns real property in florida on january 1, makes the property his or her permanent residenceor the.

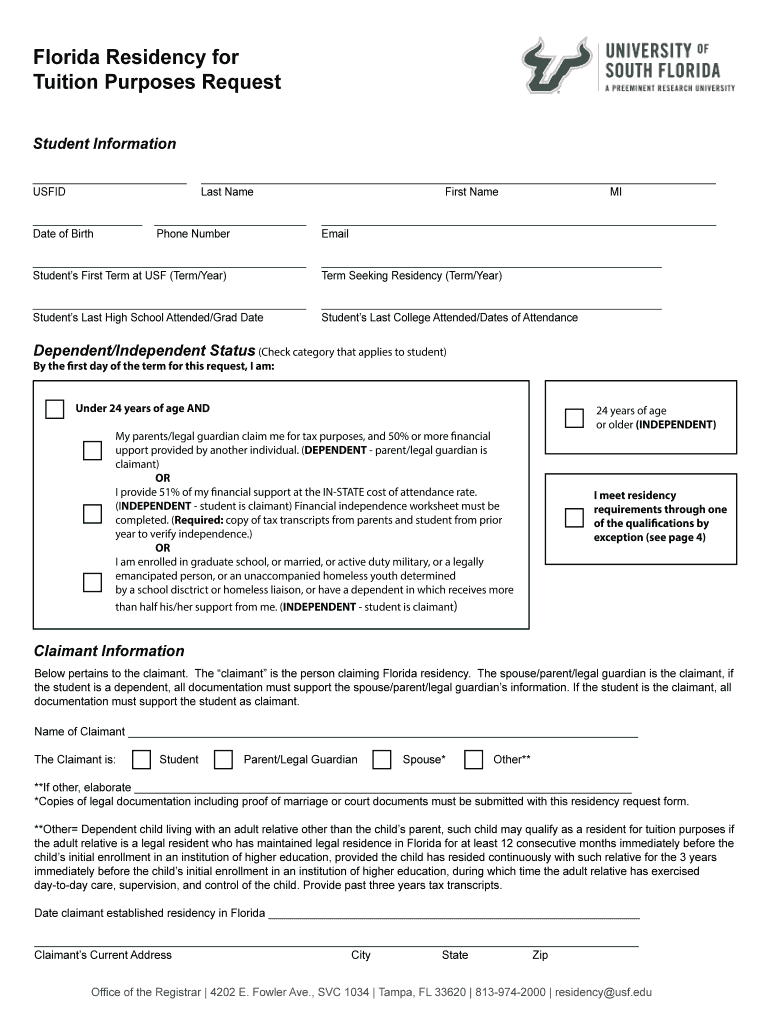

Florida Residency Guide PDF 20192024 Form Fill Out and Sign

Florida Homestead Residency Requirements the homestead exemption in florida can save you hundreds of dollars in property taxes if you are a permanent. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her. a taxpayer must reside on the property on january 1 of the relevant tax year in order to satisfy the requirements of article vii,. every person who owns real property in florida on january 1, makes the property his or her permanent residenceor the. (1) (a) a person who, on january 1, has the legal title or beneficial title in equity to real property in this state and who in good faith. if you elect to purchase a residence in florida, you also have the option to establish florida residency and claim the florida homestead. the homestead exemption in florida can save you hundreds of dollars in property taxes if you are a permanent.

From www.pinterest.com

Estate Implications for Florida Homestead Property in a Revocable Trust Florida Homestead Residency Requirements a taxpayer must reside on the property on january 1 of the relevant tax year in order to satisfy the requirements of article vii,. (1) (a) a person who, on january 1, has the legal title or beneficial title in equity to real property in this state and who in good faith. every person who owns real. Florida Homestead Residency Requirements.

From www.dreamstime.com

Beautiful Residential Landscape Homestead Florida Homes Townhomes Stock Florida Homestead Residency Requirements if you elect to purchase a residence in florida, you also have the option to establish florida residency and claim the florida homestead. a taxpayer must reside on the property on january 1 of the relevant tax year in order to satisfy the requirements of article vii,. every person who owns real property in florida on january. Florida Homestead Residency Requirements.

From lorivella.com

What to know about Florida Homestead Law Office of Lori Vella, PLLC Florida Homestead Residency Requirements a taxpayer must reside on the property on january 1 of the relevant tax year in order to satisfy the requirements of article vii,. (1) (a) a person who, on january 1, has the legal title or beneficial title in equity to real property in this state and who in good faith. every person who owns real. Florida Homestead Residency Requirements.

From www.youtube.com

𝙱𝚎𝚗𝚎𝚏𝚒𝚝𝚜 𝚘𝚏 𝚝𝚑𝚎 𝙵𝚕𝚘𝚛𝚒𝚍𝚊 𝙷𝚘𝚖𝚎𝚜𝚝𝚎𝚊𝚍 𝚎𝚡𝚎𝚖𝚙𝚝𝚒𝚘𝚗 YouTube Florida Homestead Residency Requirements a taxpayer must reside on the property on january 1 of the relevant tax year in order to satisfy the requirements of article vii,. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her. if you elect to purchase a residence in florida, you also. Florida Homestead Residency Requirements.

From www.pinterest.com

2nd page of Florida Homestead Form. See other pins for Other 2 pages Florida Homestead Residency Requirements every person who owns real property in florida on january 1, makes the property his or her permanent residenceor the. if you elect to purchase a residence in florida, you also have the option to establish florida residency and claim the florida homestead. 11 rows when someone owns property and makes it his or her permanent residence. Florida Homestead Residency Requirements.

From www.willisdavidow.com

Florida Homestead and its Hidden Traps Willis & Davidow Florida Homestead Residency Requirements 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her. if you elect to purchase a residence in florida, you also have the option to establish florida residency and claim the florida homestead. every person who owns real property in florida on january 1, makes. Florida Homestead Residency Requirements.

From www.youtube.com

Exploring the Florida Homestead Act Your Guide to Protecting Your Florida Homestead Residency Requirements 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her. if you elect to purchase a residence in florida, you also have the option to establish florida residency and claim the florida homestead. a taxpayer must reside on the property on january 1 of the. Florida Homestead Residency Requirements.

From www.exemptform.com

Florida Homestead Exemption Form Broward County Florida Homestead Residency Requirements the homestead exemption in florida can save you hundreds of dollars in property taxes if you are a permanent. if you elect to purchase a residence in florida, you also have the option to establish florida residency and claim the florida homestead. every person who owns real property in florida on january 1, makes the property his. Florida Homestead Residency Requirements.

From www.signnow.com

Florida Residency Guide PDF 20192024 Form Fill Out and Sign Florida Homestead Residency Requirements 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her. every person who owns real property in florida on january 1, makes the property his or her permanent residenceor the. if you elect to purchase a residence in florida, you also have the option to. Florida Homestead Residency Requirements.

From printablemapforyou.com

Homestead Florida Map Printable Maps Florida Homestead Residency Requirements (1) (a) a person who, on january 1, has the legal title or beneficial title in equity to real property in this state and who in good faith. every person who owns real property in florida on january 1, makes the property his or her permanent residenceor the. a taxpayer must reside on the property on january. Florida Homestead Residency Requirements.

From www.datuopinion.com

Opiniones de Homestead (Florida) Florida Homestead Residency Requirements a taxpayer must reside on the property on january 1 of the relevant tax year in order to satisfy the requirements of article vii,. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her. if you elect to purchase a residence in florida, you also. Florida Homestead Residency Requirements.

From asrlawfirm.com

The Florida Homestead Exemption Florida Real Estate ASR Law Firm Florida Homestead Residency Requirements the homestead exemption in florida can save you hundreds of dollars in property taxes if you are a permanent. a taxpayer must reside on the property on january 1 of the relevant tax year in order to satisfy the requirements of article vii,. 11 rows when someone owns property and makes it his or her permanent residence. Florida Homestead Residency Requirements.

From www.youtube.com

Florida Homestead Exemption Explained YouTube Florida Homestead Residency Requirements 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her. (1) (a) a person who, on january 1, has the legal title or beneficial title in equity to real property in this state and who in good faith. a taxpayer must reside on the property. Florida Homestead Residency Requirements.

From www.hauseit.com

What Is the Florida Homestead Property Tax Exemption? Florida Homestead Residency Requirements if you elect to purchase a residence in florida, you also have the option to establish florida residency and claim the florida homestead. the homestead exemption in florida can save you hundreds of dollars in property taxes if you are a permanent. (1) (a) a person who, on january 1, has the legal title or beneficial title. Florida Homestead Residency Requirements.

From uptownsuites.com

Extended Stay Uptown Suites Miami FL Extended Stay Homestead Florida Homestead Residency Requirements a taxpayer must reside on the property on january 1 of the relevant tax year in order to satisfy the requirements of article vii,. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her. every person who owns real property in florida on january 1,. Florida Homestead Residency Requirements.

From www.meyerlucas.com

How To Homestead Your Residential Real Estate In Florida — Meyer Lucas Florida Homestead Residency Requirements if you elect to purchase a residence in florida, you also have the option to establish florida residency and claim the florida homestead. every person who owns real property in florida on january 1, makes the property his or her permanent residenceor the. 11 rows when someone owns property and makes it his or her permanent residence. Florida Homestead Residency Requirements.

From verobeach.com

HOMESTEAD EXEMPTION = An Awesome Property Tax Break for Florida Florida Homestead Residency Requirements a taxpayer must reside on the property on january 1 of the relevant tax year in order to satisfy the requirements of article vii,. if you elect to purchase a residence in florida, you also have the option to establish florida residency and claim the florida homestead. 11 rows when someone owns property and makes it his. Florida Homestead Residency Requirements.

From www.esclaw.com

Florida’s Unique Homestead Laws A DoubleEdged Sword Emmanuel Florida Homestead Residency Requirements the homestead exemption in florida can save you hundreds of dollars in property taxes if you are a permanent. a taxpayer must reside on the property on january 1 of the relevant tax year in order to satisfy the requirements of article vii,. 11 rows when someone owns property and makes it his or her permanent residence. Florida Homestead Residency Requirements.